Nowadays, there are a lot of tempting items and products that can make you sway from your budget without even knowing it. Perhaps you’ve bought one cheap item here, and another there, and next thing you know, you’re running short in money. This is especially true for students who have to keep their allowance in check. Often, people tend to spend a lot when they receive their salary or allowance, usually at the end of the month, and then run short before the next payday. Luckily, there’s an easy way to keep track of your money and keep everything within budget using nothing else but what you already carry around all day, every day—your smartphone. There are a lot of apps out there that can efficiently help you in managing your finance. Here are seven apps that will help you save money.

- Mint

Mint is one of the best personal finance apps there are. Not only will it keep track of all of your financial activities from all of your accounts, it takes note of your spending patterns and creates a budget for you as well. Every transaction you make from any of your accounts will be automatically recorded and organized but don’t worry, the app is password protected and you can deactivate it through the Mint website. The best part is that you can get all of these features and more for free.

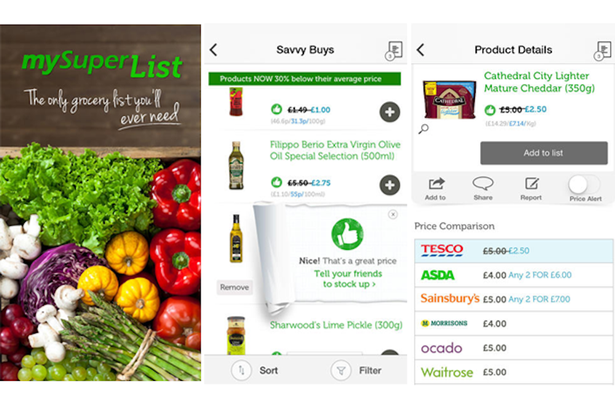

- mySuperList

When it comes to saving money for food, this app is the one you’re looking for. You can create a shopping list in the app and it will help you find which supermarkets are selling those items for the cheapest price, allowing you to make a huge saving. You can even get cashback on certain items with the help of the app.

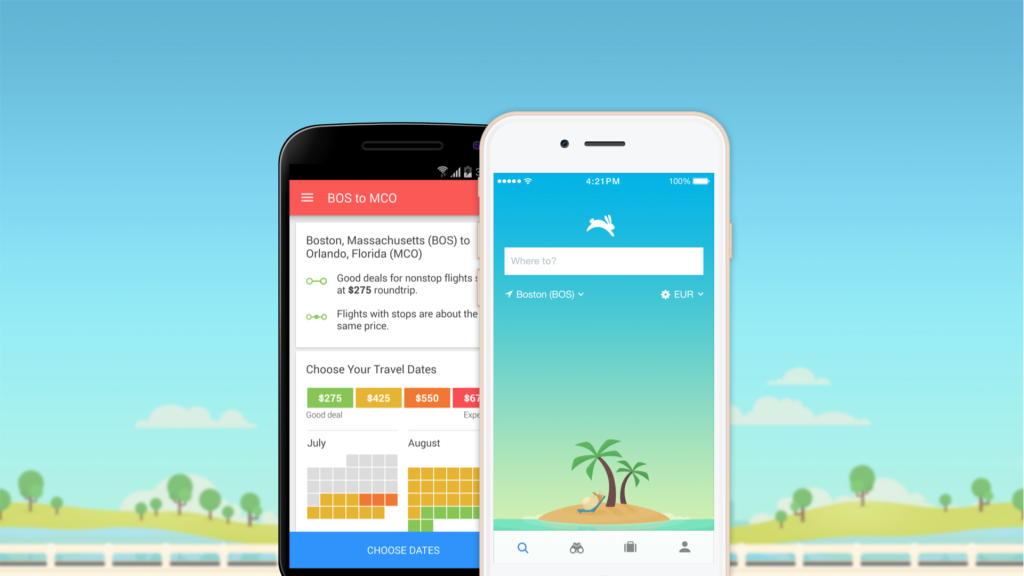

- Hopper

For people who like to travel or who are planning to travel, Hopper can help you save a couple of bucks. Hopper features a finely tuned price-prediction design that can help you get the lowest airfares for certain flights. The app will help you figure out the best time for you to fly and the best time for you to buy tickets for that flight so you can get it at a cheaper price.

- Level

Level helps you save money by syncing your checking or savings account then automatically updating how much spendable cash you have according to the amount of money you’ve spent for that day. It will also calculate your average daily spending so it can predict your financial status over the next week or month and whether you’ll have enough money to support your spending habits.

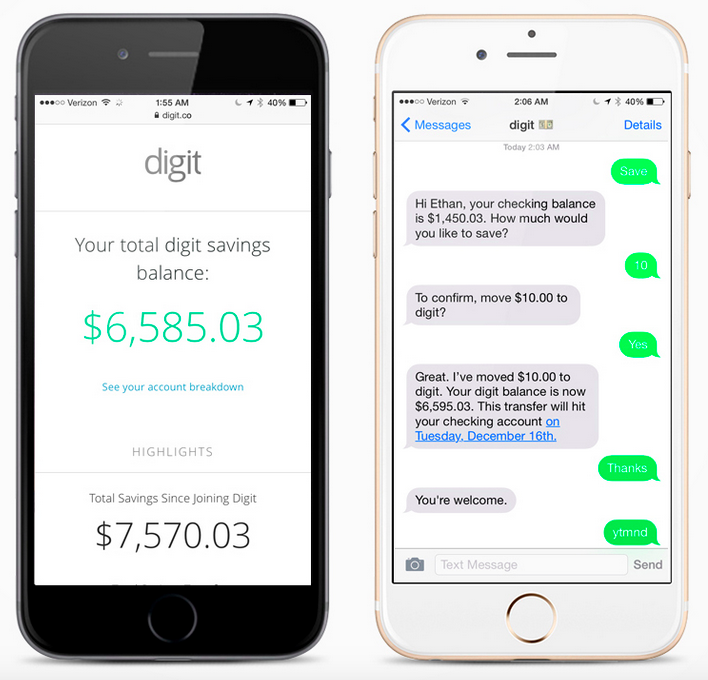

- Digit

Digit can help you save money without even knowing it. The app does this by calculating your income and spending patterns then transferring a small amount of money that the app deems you won’t necessarily need to a separate savings account that it manages. This separate savings account won’t have interest though but you can withdraw from it anytime.

- You Need A Budget (YNAB)

The name of the app says it all. Basically, the software runs on four simple rules: first, give every dollar a job; second, to have savings for a rainy day; third, to roll with the punches; and finally, to live on last month’s income. The app is only a supplement to the Windows or Mac software you can purchase for $60. Although it may seem quite pricey, the app can offer you a better insight of your financial situation and is definitely worth the investment.

- Unsplurge

Unsplurge is a great app if you’re trying to save money for something in specific. You enter in the app what you’re saving for and how much you have to save and then the app will track your progress and give you saving tips to make your goal more achievable. You can even view other people’s saving goals to promote a saving mentality in yourself.